Overview

Event risk (a rapid market decline in response to breaking news) is rising in the market, as we pointed out last week. For example, the threat of China Evergrande default pushed the VIX into resistance near 29-30, but the index retreated rapidly from there, the classic signature of a headline-risk event.

We may have set a key low on Monday, with a roughly -5.28% drop from the 4545 high to the 4306 low for this move. The action in the VIX Index suggests this is a key low, though a retest seems likely, perhaps even necessary.

The market absorbed some selling on Friday but closed higher at the end of the day, a reversal of the past two weeks.

Political risks are rising as Congress tries to meet various legislative deadlines. Any hiccups along the way could lead to bouts of selling.

China cracked down on cryptocurrencies on Friday, possibly eroding risk appetite.

Key Question

Where does the S&P-500 go from here? Does this week’s market action give us any clues about down-side targets? Technical analysis has developed various ways to estimate downside risk. In fact, these are little more than guesses. However, they do give us some estimates for managing risk.

Performance Summary

The marked sold-off heavily on Monday, with a spike in the VIX and a spike low near 4300. It then rallied strongly, bouncing some 3.69% during the week. As we can see below, the rally was quite broad by the strong returns on the RSP (equal weight S&P-500 index) versus the capitalization-weighted S&P-500 index itself. Small-cap and mid-cap stocks were also up nicely, a good sign for the bulls. Technology stocks lagged, as seen by their negative returns for the week. The US 10-year yield rose 10 basis points to 1.47%, and the Energy sector was also strong this week, both signs that the market expects GDP growth to resume.

The Bull/Bear balance from leveraged and inverse ETFs tells the story of the week quite nicely. The sell-off pushed this indicator below -60 early in the week, but then it rebounded to close near +54, quite a round-trip in a single week.

US equity sectors (below) show that the strongest sectors were in the energy sector, communication services, and health care.

What is event risk?

The sharp sell-off on Monday and subsequent rapid rebound are the signatures of event risk in the market. First, the possible default of a company far away, with an FOMC meeting on tap, motivated traders to imagine the worst. As a result, the volatility index or VIX rose rapidly into resistance. Then, as the FOMC followed suit, generally conforming to market expectations, traders found their mojo, and we had a rip-roaring rally, with a corresponding decline in the VIX Index. I view this as the classic signature of event risk in the market.

Where does the market go from here?

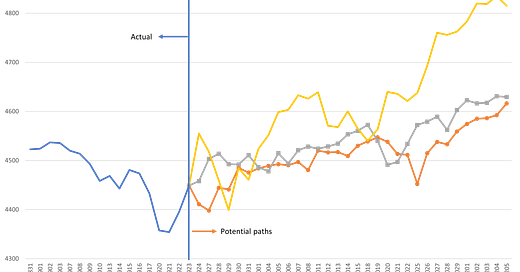

The short answer? Higher, eventually. I find it easier to think in terms of price levels. We got a -5% or so correction and then a rapid 62% retracement of that decline. I have seen this type of price action many times before. We use the current range (4546-4306=240 points) as our scale for further declines. Since the rebound was to 4465 or so, the down-side target is 4225 (=4465-240), near the May-June 2021 highs, as shown below. A more pessimistic target would be the 200-day moving average, around 4120, but it will keep rising for the next few weeks.

Conversely, for the uptrend to resume, the market must first rise above 4500. The news background is the key here. First, the FOMC meeting this week clarified the future course of the Fed’s actions. Second, COVID-19 is now peaking, as we suggested a couple of weeks ago. Third, Congress is the key remaining source of uncertainty, and we may have to wait for them to finish their work before the rally resumes. Fourth, political decisions abroad could continue to rock the boat, but their shock value will likely diminish. Finally, soon there will be speculation about consumer spending being affected by supply chain issues, but that is a concern for another day.

I looked at the S&P-500 paths from this year’s lows in March, May, and July to draw three speculative paths forward for the S&P-500 index through early December to give you a feel for how the rebound might evolve. Of course, I do not know what the market will do, but this gives you a sense of what might happen if it repeats its actions earlier this year.

Over the next week or so, the resistance in the SPY is at 447, and support is at 435, which means the very short-term trend is higher unless we get a close below 435.

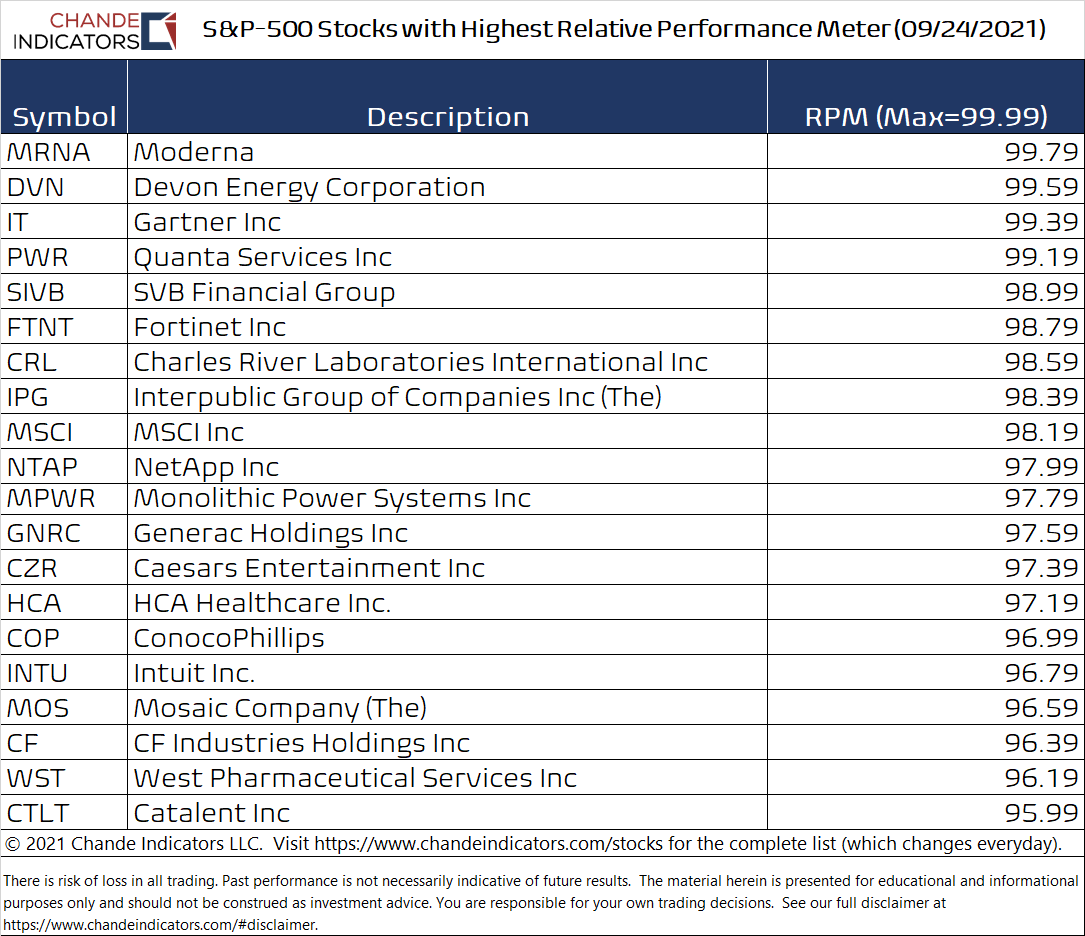

Strongest Stocks in the S&P-500 Index

Since the market has seen some selling, now is a good time to review the stocks with the strongest relative performance in the S&P-500 index for investing ideas. (See my website for short-term and long-term trend strength ranks).

Wrap-up

If you like to do your own research, my posts should give you a good starting point, with context and suggestions. Then, you can visit my website, chandeindicators.com, for more information and ideas. I hope you will stay tuned and help by subscribing and recommending it to your friends and colleagues.

Thank you for spending some time with me.

Disclaimer

And now for some housekeeping. This publication is for “edutainment,” education, information, and entertainment purposes only. It is not to be construed as investment advice. Past performance is not necessarily indicative of future results. Our disclaimer at chandeindicators.com is included herein by reference.