Trailing TSLA: A Tutorial on Trailing Stops

We explore volatility-driven trailing stops using Tesla (TSLA).

Overview

Markets were weak again this week, with the S&P-500 fragile for the second Friday in a row, often a sign of institutional repositioning.

Small stocks were a bright spot, up slightly for the week.

Expect more weakness going into the FOMC meeting later this month.

Overall, the indexes are holding up well, but the month is only half done.

Key Question

Negative headlines have been ubiquitous since the start of September. But, unfortunately, no one really knows exactly what the market will do. In other words, if it doesn’t go up, it will go down. So, rather than be swayed by headlines, is there a way to manage your position objectively? One answer might be to use a trailing stop. Today I will discuss a volatility-based trailing stop from my book (Chande and Kroll, “The New Technical Trader,” via Wiley).

Performance Summary

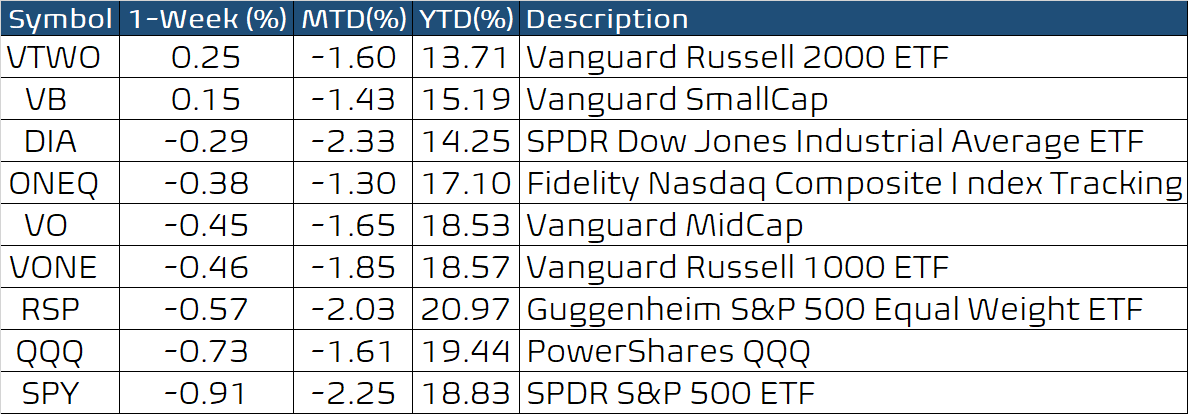

Small-cap stocks eked out a positive weak, and large-cap stocks weakened at week’s end to push the SPY lower. Overall the tone remains negative, though the SPY is approaching support and has touched its 50-day moving average.

The sensitive Bull/Bear balance from leveraged and inverse ETFs is still weak but barely negative, showing that the selling has been relatively moderate.

Below the index level, a look at the major US equity sectors shows that selling has now pushed both the very short-term and short-term breadth below zero, so as usual, the indexes are painting a more moderate view of the price action.

The major Vanguard market capitalization-focused ETFs show that the selling has now pushed short-term returns into negative territory, with value-oriented ETFs the weakest, as we expect during a down-move in the market. On the other hand, the growth-oriented ETFs have held up the best, and I would expect these to perform well when the uptrend resumes.

Trailing Stops - A Tutorial

What is a trailing stop?

A trailing stop is an order to exit a position at or near a preset price to protect profits or preserve trading capital. Trailing stops use a stop-loss order which becomes a market order when prices trade through the stop price. (Please consult your broker for the details of their implementation.) The broker will execute your order when specific conditions are fulfilled to trigger the stop, but the fill price is not guaranteed.

In technical analysis, a trailing stop is simply an algorithm that calculates an exit price for a stop-loss order as it follows or trails behind the prices. Today’s trading software can automatically update the trailing stop, so the market will get you out when it trades through your stop.

Who needs a trailing stop?

A trailing stop is needed only if you plan to hold the position for a “short” time. For example, if you want to hold a position for many years or decades, you may not need a trailing stop.

Are trailing stops “perfect”?

No, they are not the perfect way to exit every trade. If you trade for a long time, sooner or later, you will find that a stop shakes you out of a position, only to see the stock or commodity resume its prior trend. In hindsight, you will wish the stop had been closer (or farther away) for a given trade.

Is there more than one way to calculate the stop?

Yes, indeed. If you ask ten people, you will find thirty different ways to calculate stops.

What are the tradeoffs in calculating trailing stops?

The fundamental tradeoff is speed versus the ability to absorb volatility. Does your algorithm absorb some volatility without taking you out of the main trend? Does your stop move rapidly when the market itself is moving rapidly? Does the stop slow down when the market consolidates? Is your stop unidirectional (it keeps advancing regardless of market action)? There are many ways to calculate a trailing stop. For example, something as simple as a simple moving average can be used as a trailing stop.

Trailing Tesla - A Case Study

We begin by looking at Tesla (TSLA) in November-December 2020 before it joined the S&P-500 index. Naturally, a rally in TSLA was all but “guaranteed” due to demand from S&P-500 index ETFs and funds. How high would TSLA go? Would it stop rising once it entered the index just before Christmas, 2020? Let us look at the chart below.

Starting from the left, TSLA was consolidating, moving sideways within a triangular wedge, with a narrowing price range, often a precursor for a rapid breakout. In this case, TSLA broke out to the upside. Notice that the height of the bars was small within the triangle, but the daily range started expanding during the move, with a large red bar (down day) nine days into the move? This large bar increased the volatility. But was this the top? In other words, a trailing stop is ideal for this trade because it would follow prices and give you a specific point to exit without trying to guess what TSLA would do next.

Let us follow the prices as they broke above the upper boundary of the triangle. Initially, you could worry about the breakout and wonder if it was real. In the figure above, I show TSLA with the Chande Trend Meter (CTM) plotted in the upper panel, which works as a tool to confirm the breakout. (It measures trend strength using many different indicators.) A move in the CTM above 80 confirms the breakout. So, at this point, you might be confident to put on a position, going long.

Now, let us add two more indicators: the 100-day price channel (green line) and the trailing stop (red dots). Notice that the breakout pushed TSLA to make a new 100-day high, which means it exceeded its high from 100-days ago. I think this is usually another sign of trend strength in a stock. We now have multiple confirmations (CTM > 80, new 100-day high). Even without the additional information of TSLA being added to the S&P-500, we can be confident that the stock is trying to go higher. All we now need is an entry point and an exit level. We could buy at the market and simply place a trailing stop to exploit this trend.

The Chande trailing stop (red dots below the prices) works off the 100-day high. First, it uses a proprietary calculation to estimate the expected daily price movement or volatility amplitude. Then, it subtracts six times the daily volatility from the previous day’s 100-day high to calculate the location of the exit. Thus, the stop implies that a decline of 6 daily volatility units below the 100-day high means the trend has ended, and it is time to exit.

Observe how this trailing stop works. First, when the market makes a new 100-day high, the stop rises. Second, the stop barely budges when TSLA consolidates below a recent high (without making a new high). Third, this is a relatively “wide” stop since it allowed the TSLA to have large red bars without exiting, i.e., without assuming that the trend was about to end.

Eventually, in late January, prices came down to the trailing stop, and you would have exited the position, close to but not at the absolute high for the move. If you did not exit the position when it first approached the trailing stop, you could have exited at the retest of the old highs or later in February, as it broke below the trailing stop again.

Now, I have used a 6x multiple for my wide stop, based on trading many different types of instruments. Based on your objectives, you could make the stop wider (use 10x multiple) or tighter (use 2x~4x multiple). The chart below shows a 6x stop (green line), and a 10x stop (red dots now) to show you that a 10x stop is much wider but might be the better answer if you want to hold the trade longer. There is simply no way to guess which multiple would work best a priori for a given trade.

We illustrate the 6x vs. 10x stop at another point in the TSLA chart to show how the same stop has different effects based on price action (which we cannot necessarily forecast in advance).

How do I implement this stop?

In practice, you would enter a (GTD/GTC) stop-loss order with your broker and update the exit stop price regularly. Alternately, if your trading platform has this feature, you could automate the exit strategy, automatically updating the exit order price for you. Here GTD means good for the day, and GTC means good till canceled, which describes the duration for which the order should be active.

The Advantages of this Stop

The advantages of this stop are that it is responsive when markets trend and can absorb a good bit of volatility, so you are not easily shaken out of major trends.

Where can I find this stop?

You can find this stop in TradingView.com, in my new MetaStock package, or NinjaTrader. There are many variations on this stop that are available in other packages.

Wrap-up

If you like to do your own research, my posts should give you a good starting point, with context and suggestions. Then, you can visit my website, chandeindicators.com, for more information and ideas. I hope you will stay tuned and help by subscribing and recommending it to your friends and colleagues.

Thank you for spending some time with me.

Disclaimer

And now for some housekeeping. This publication is for “edutainment,” education, information, and entertainment purposes only. It is not to be construed as investment advice. Past performance is not necessarily indicative of future results. Our disclaimer at chandeindicators.com is included herein by reference.