40 Stocks to Exploit the Rising Risk Appetite

We celebrate the return of animal spirits in the markets.

Overview

Fed Chair Powell’s speech to the Jackson Hole Symposium quieted the market’s concerns about tapering bond purchases and interest rate hikes. He signaled that the Fed would reduce bond purchases later this year, but rate hikes are still a long way off.

The S&P-500 and Nasdaq made new highs, showcasing the strength of large-cap and tech stocks.

Small stocks continued to rally off their test of the consolidation lows last week.

Key Question

With markets making new highs, fear of Federal Reserve policies fading, smalls stocks apparently finding their footing, has risk appetite returned to the market? We offer a list of QQQ and S&P-500 stocks to exploit the return of animal spirits.

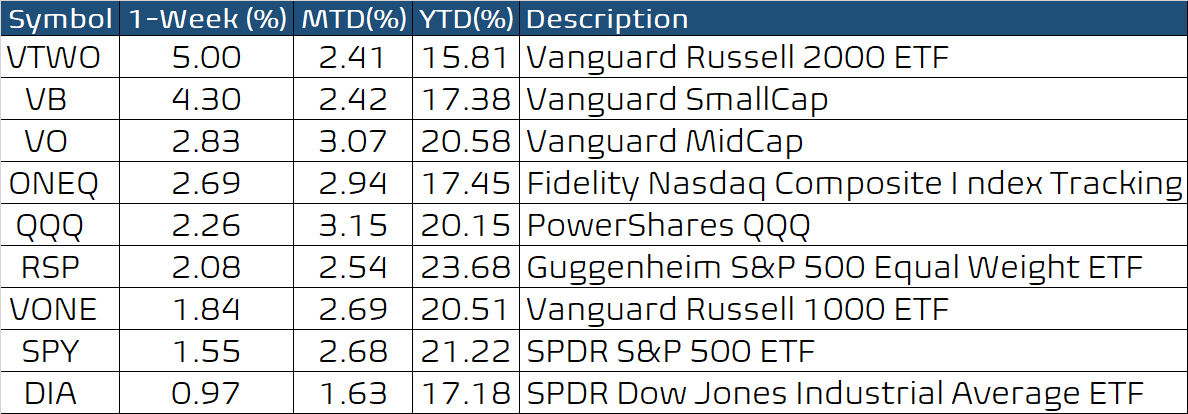

Performance Summary

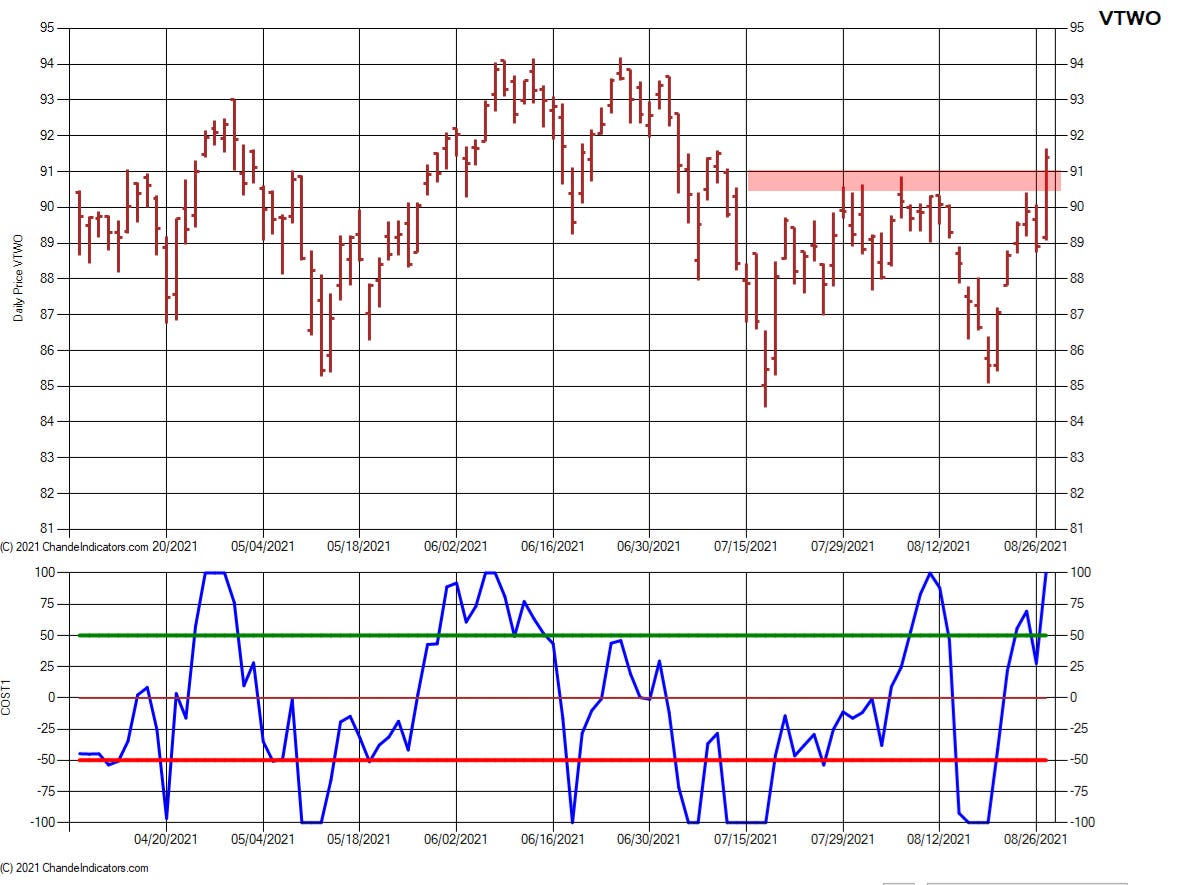

The convincing rally in small stocks (see VTWO, VB, VO below) was the best news this week for market bulls. We have been harping on the relative weakness in smallcap stocks and how they had been quite weak even as their mega-cap cousins kept rising. However, we observed that smallcap stocks had successfully retested their lows last week, and today’s strong rally after Fed Chair Powell’s speech was proof of the return of animal spirits to this sector.

The Vanguard Russell 2000 ETF finally broke above its resistance around 91, and the broader Vanguard Small-Cap ETF is now about to make new highs. These are very bullish for the market as a whole.

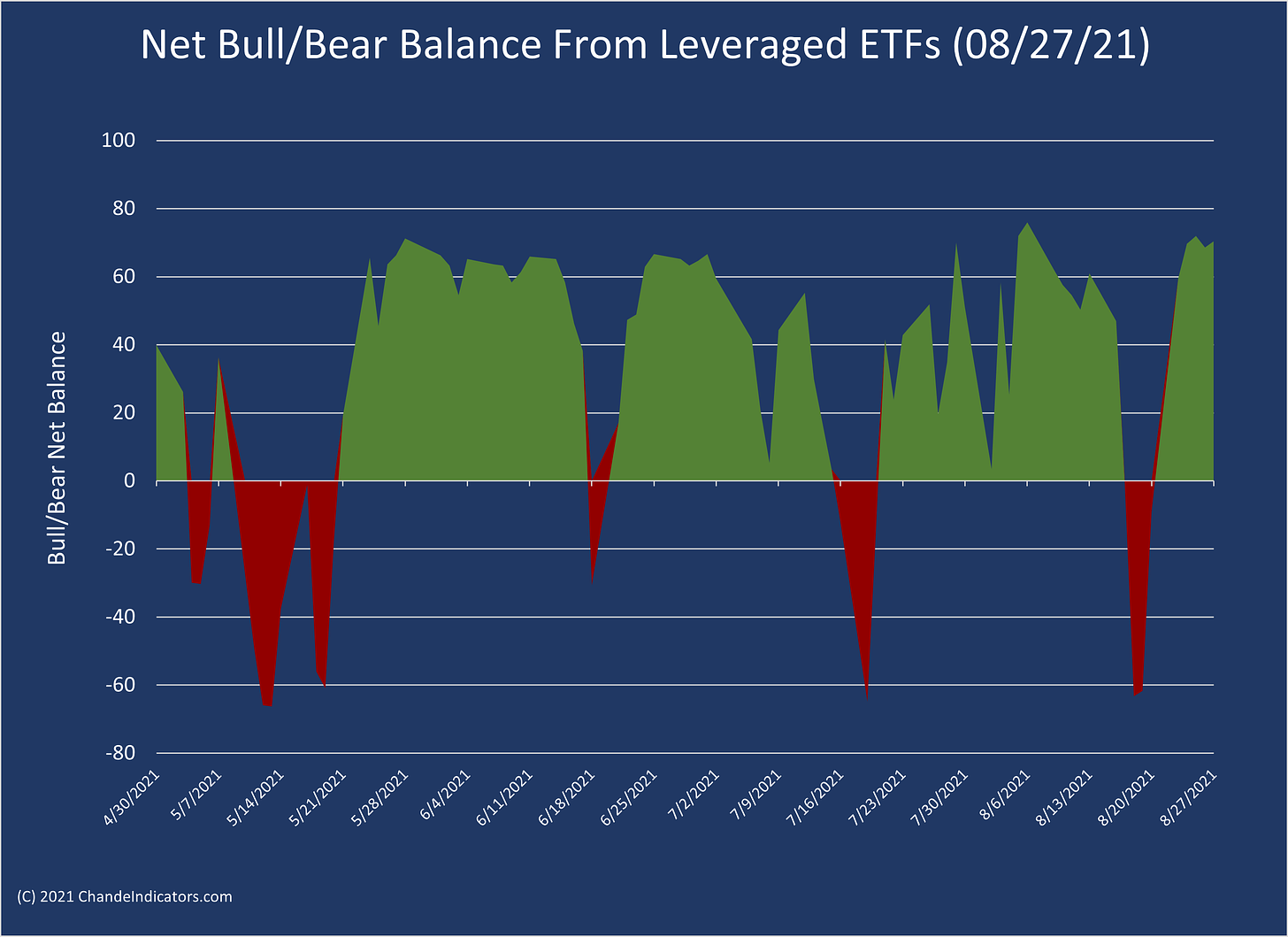

The sensitive net bull/bear balance from leveraged and inverse ETFs rose to a strong reading above 71 after being in the red last week. It just goes to show that trading has been quite choppy even as the market has climbed a wall of worry.

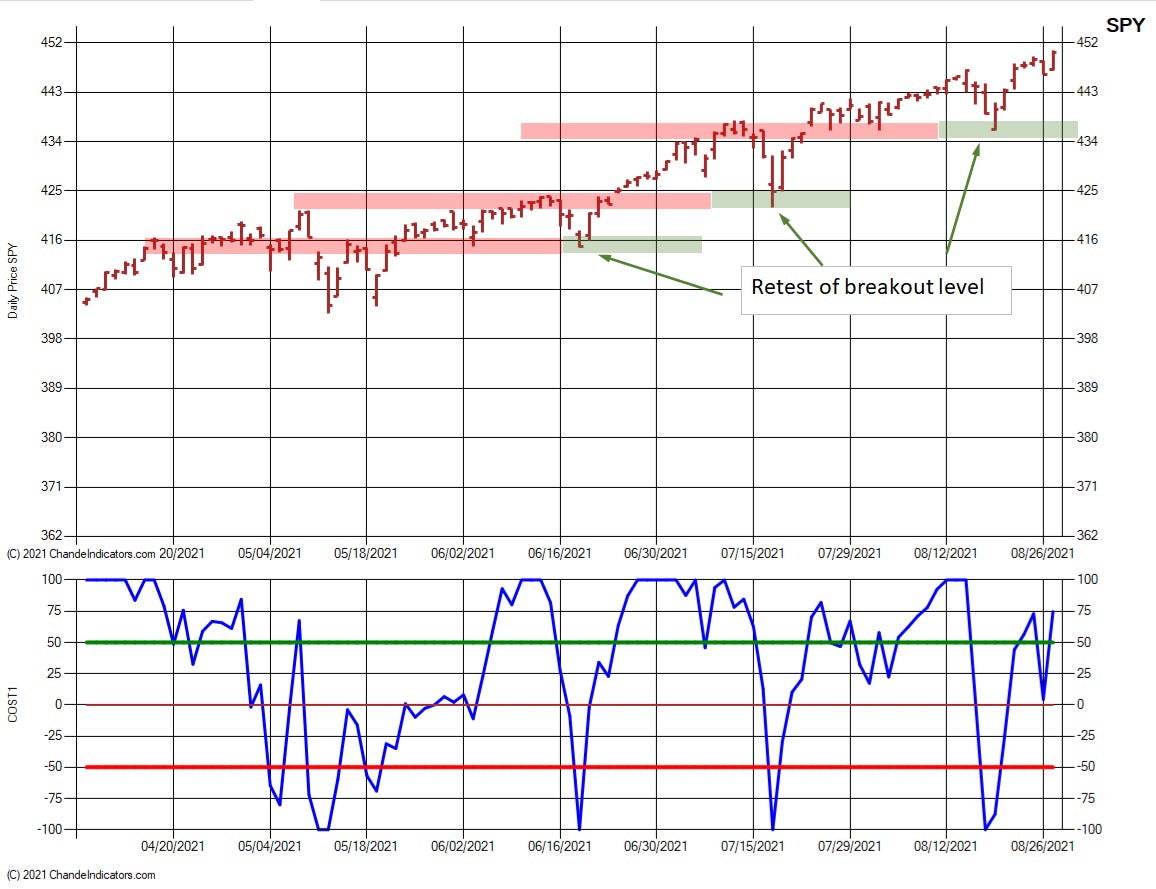

The S&P-500 has been rising in stair-step pattern, with each pullback testing the previous breakout. Overall, this is a very bullish pattern, demonstrating the market climbing the proverbial wall of worry.

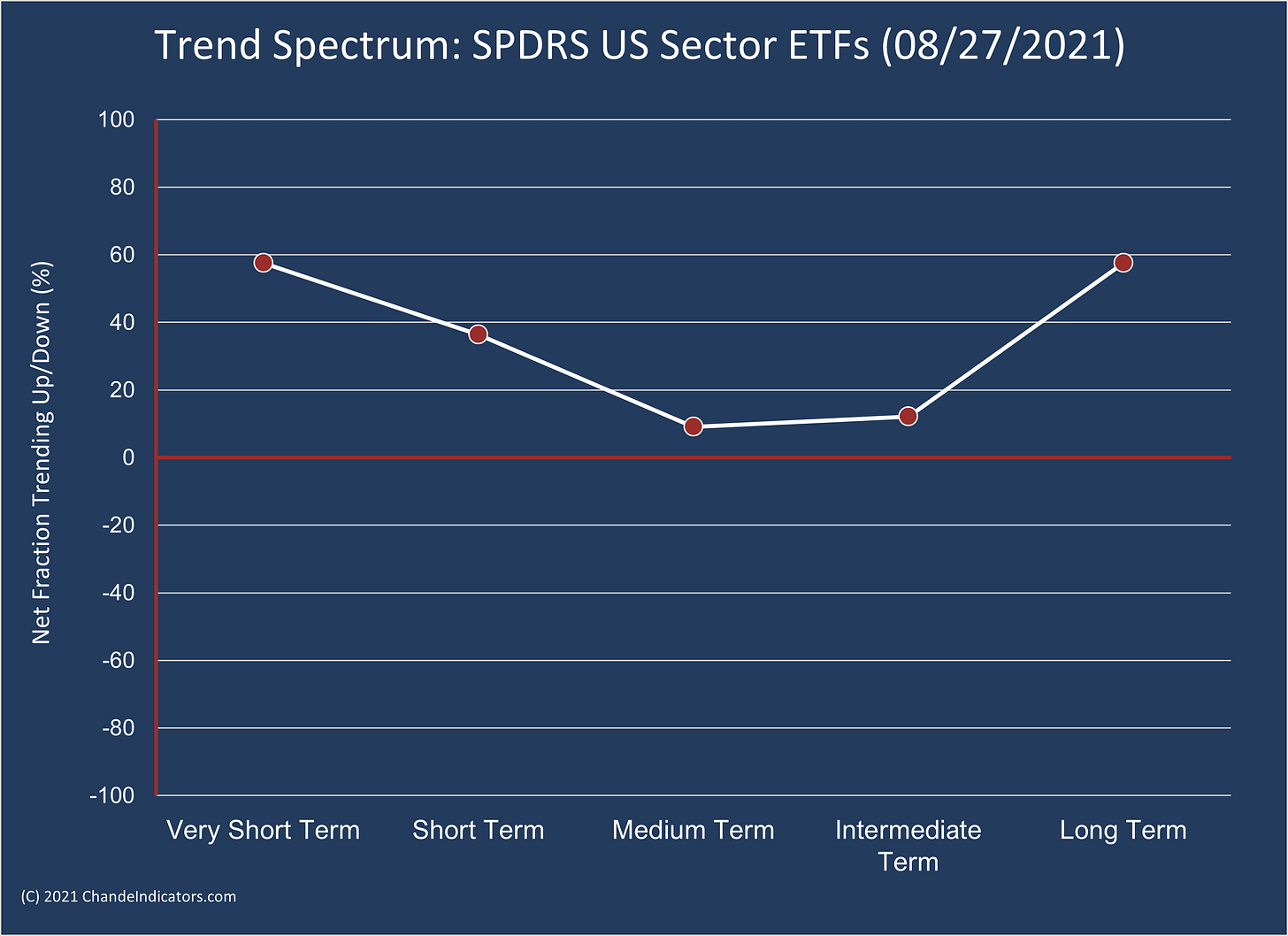

The bounce this week is visible in our trend spectrum chart, with the very short-term trends now pointing higher. However, the medium-term and intermediate-term trends are weaker than the very short-term or long-term trends because the market has been consolidating for several months.

Signs that Risk Appetite is Rising

1. Bitcoin has bottomed and run up into resistance near 50,000 that we have identified previously.

2. Long-term interest rates, via US 10-year yields, have climbed above 1.30%, well above their recent lows below 1.15%. In addition, this yield is now above both its 50- and 200-day moving averages.

3. Small stocks indexes have not made new lows and have moved above their 50-day moving average (see, for example, the VTWO chart above.)

4. Value stocks have rallied and moved above their 50-day average (see IWN below).

We show a couple of charts below in support of the above list. Observe below how both the Bitcoin cryptocurrency and US 10-year yields seem to have bottomed in late July, suggesting that the bearish sentiment has been forgotten for now. The 10-year yields found support near the 50% retracement we had identified earlier.

We reproduce below the 10-year yield retracement chart from our earlier post with a red arrow pointing to the 50% retracement level around 1.15% where the market found support.

The iShares Russell 2000 Value ETF closed above its 50-day 0.5 sigma bands and well above recent resistance, showing that small-cap value stocks have also rebounded after testing their July lows.

Taken together, the overall picture has turned bullish, and I hope we will have a continued rally through year-end, though the markets will not rise in a straight line (see the stair-step pattern above).

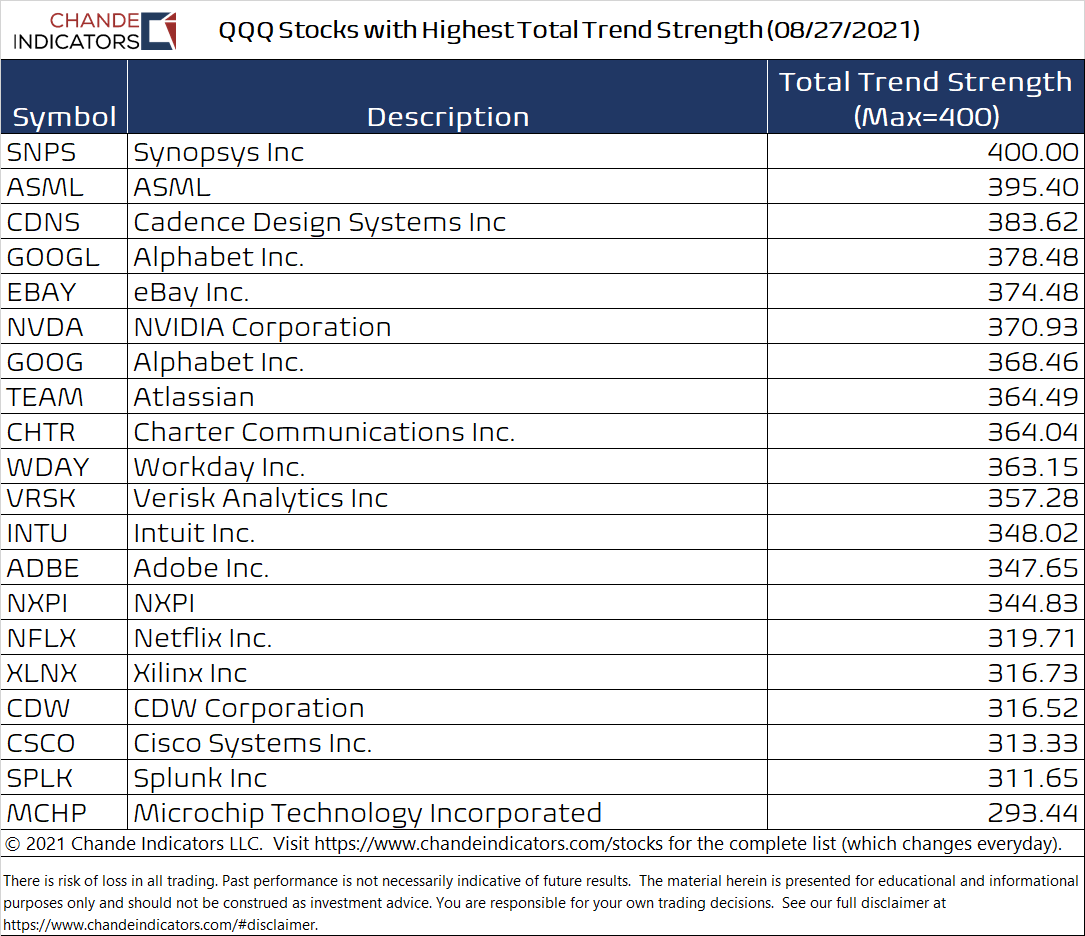

Here are some stocks in the QQQ and S&P-500 index to take advantage of these rising animal spirits.

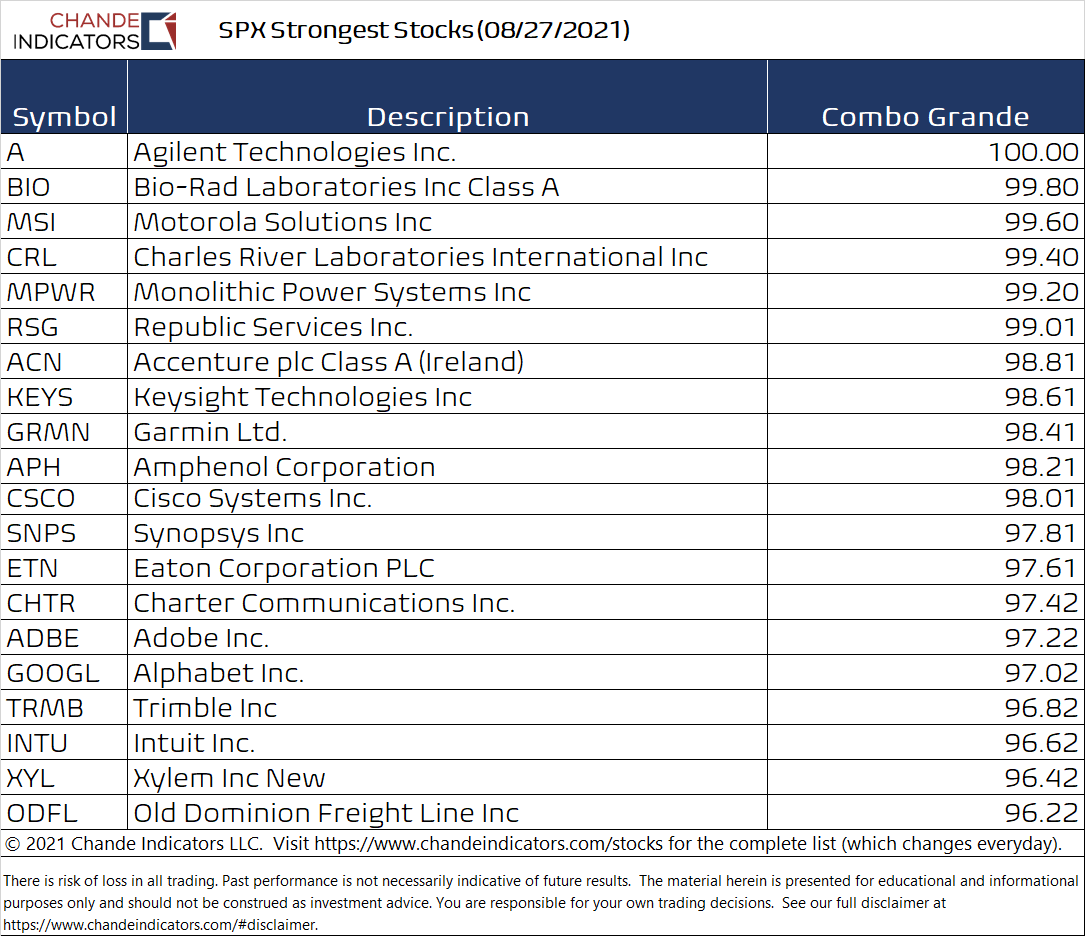

The table above is from our website, chandeindicators.com, and uses multiple measures of momentum. A more complicated ranking process yields the following list for stocks in the S&P-500 index. Some of the stocks are in both tables since they are in both indexes.

Wrap-up

If you like to do your own research, my posts should give you a good starting point, with context and suggestions. Then, you can visit my website, chandeindicators.com, for more information and ideas. I hope you will stay tuned and help by subscribing and recommending it to your friends and colleagues.

Thank you for spending some time with me.

Disclaimer

And now for some housekeeping. This publication is for “edutainment,” education, information, and entertainment purposes only. It is not to be construed as investment advice. Past performance is not necessarily indicative of future results. Our disclaimer at chandeindicators.com is included herein by reference.