Overview

A sharp drop in Bitcoin prices over the weekend coming into the trading week seemed to encourage bearish sentiment. (BTCUSD was down -26.72% over past 10 days as of 4/23 AM)

Bitcoin’s “Wild West”: Turkish Bitcoin exchange CEO absconds with $2 billion of customer funds.

A leak that President Biden may propose tax hikes on wealthy individuals also tamped down enthusiasm, since if passed, it may trigger selling to capture long-term gains at lower capital gains tax rates.

The 4200 round number is posing some resistance to the S&P 500 index, as the market has consolidated for two weeks just below it.

Key Question

Will the cryptocurrency crash curse stocks? Crypto is a good measure of speculative sentiment, and the parabolic Bitcoin rally from December 2020 has paused, for now. Will this affect overall bullish sentiment in the market?

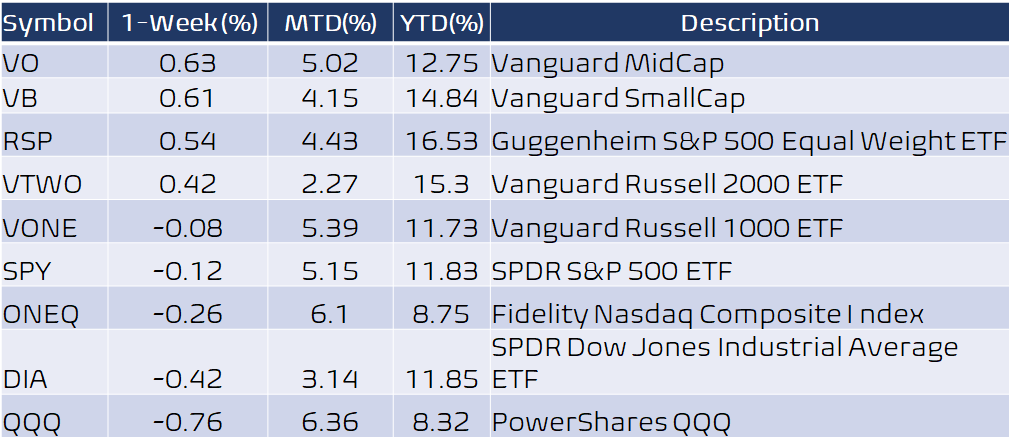

Performance Snapshot

Mid Cap stocks were the strongest performers this week, as their Big Cap cousins lagged for once. So now it’s two weeks in a row that small and mid cap stocks have been stronger the large cap stocks. Technology stocks finished the week at the bottom, as fears of tax structure changes were resolved at their expense, even though they bounced nicely on Friday as Bitcoin found support.

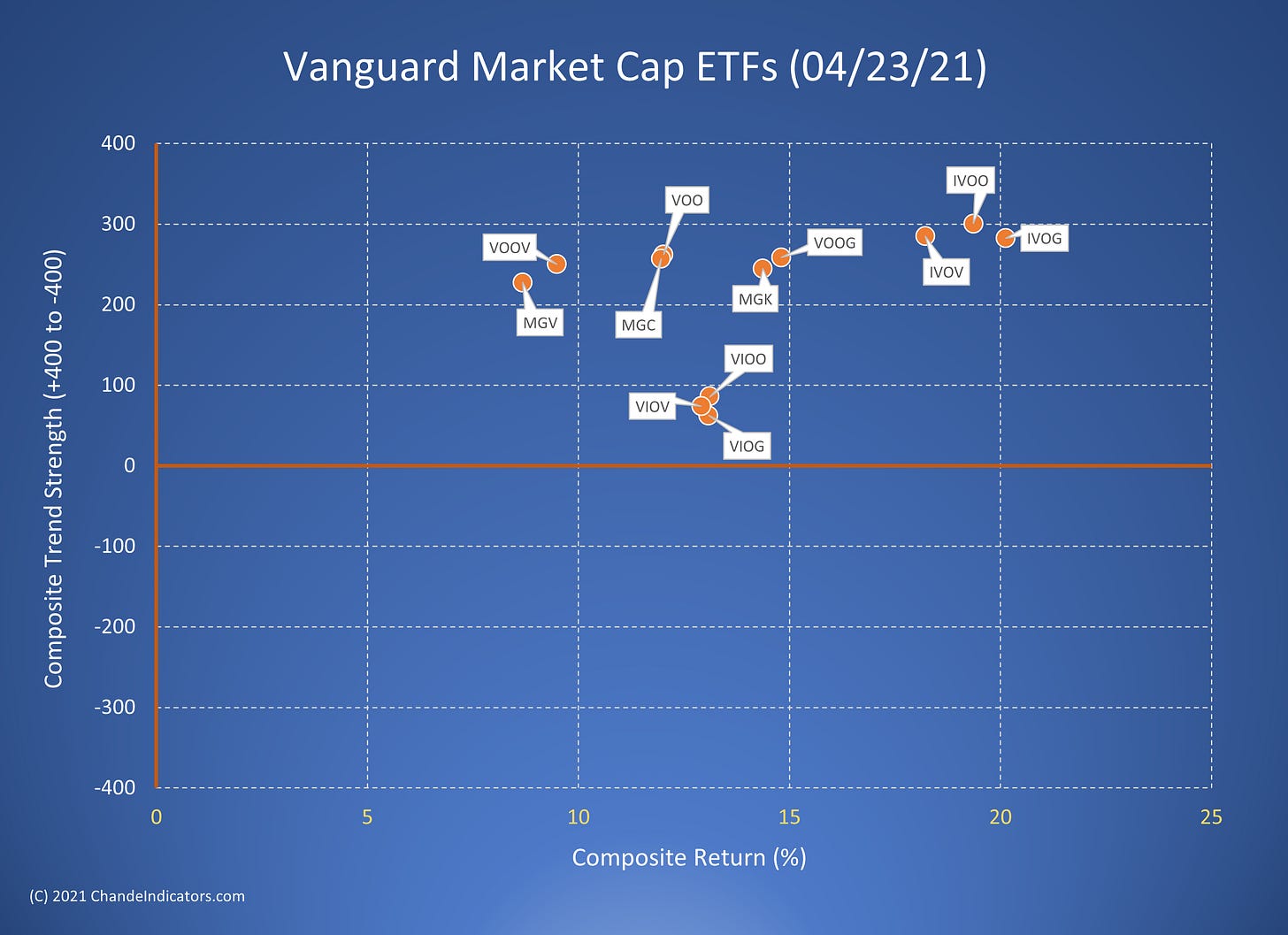

Analysis Vanguard Market Cap ETFs

Overall, the internals of the market around capitalization have improved. Most sub groups are trending, and all have positive composite return. The small cap group (VIOV, VIOO, VIOG) has improved and are now clustered mid-pack in terms of returns, but are relatively the weakest grouping per trend strength. The mid cap cluster (IVOG, IVOO, IVOV) is leading at the end of this week, both in terms of returns and trend strength. You will recall the large cap value and large cap complex was ahead a few weeks ago, so the sub-surface rotation has come full circle with Mid Caps in the lead.

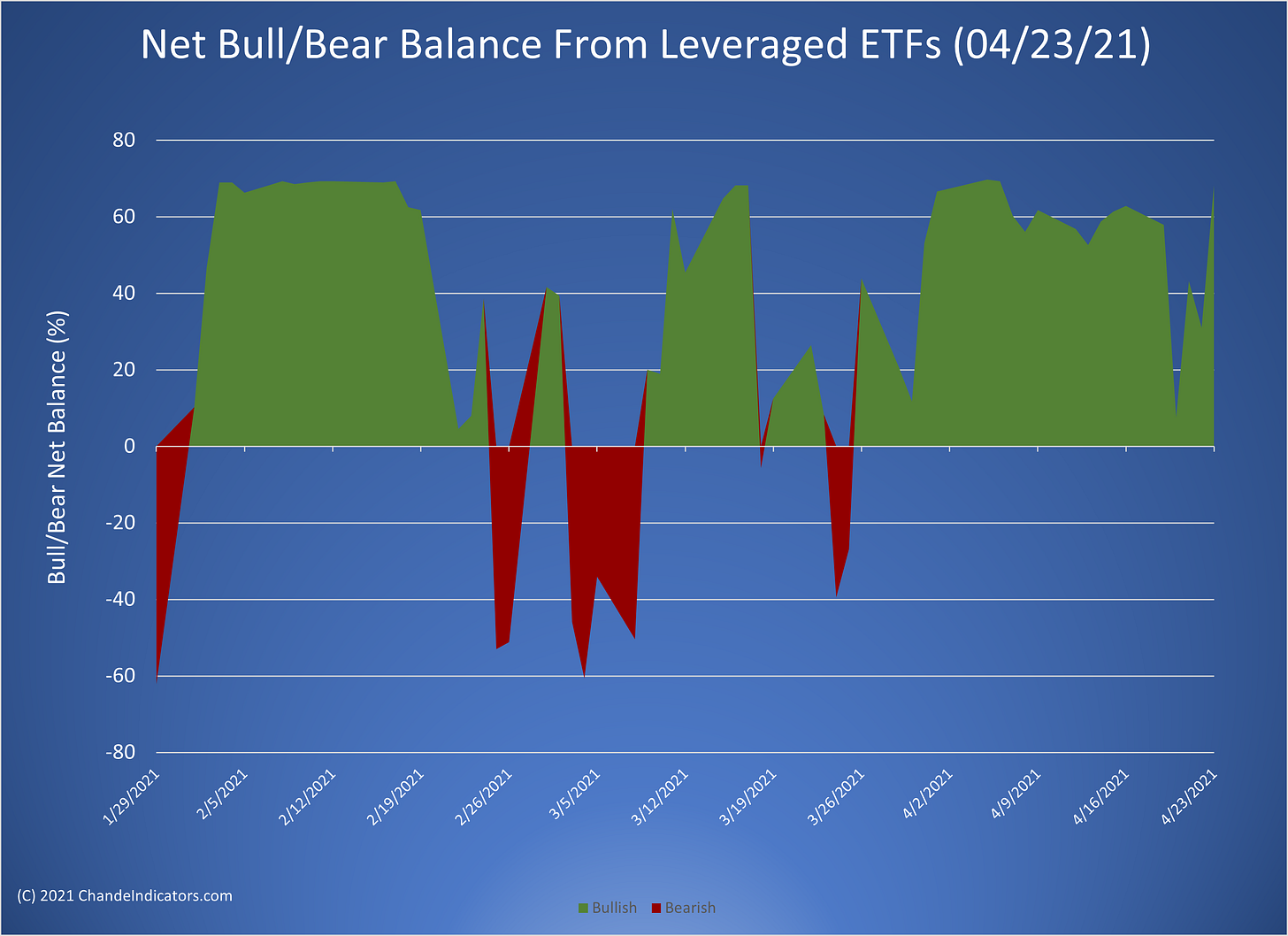

Trend Direction from Leveraged ETFs

The sell-off earlier in the week as well as the weakness in technology and large cap stocks nearly pushed the bull-bear ETF indicator into negative territory. However, the selling on Thursday reversed into buying on Friday, and the uptrend was again firmly in place. The net bull-bear ETF reading dropped below +40 this week, which is often a precursor to weakness. However, the market shrugged it all off when Bitcoin rallied ahead of the close Friday, and stocks eventually closed higher. The markets have essentially gone sideways for two weeks here, but the SPY even made a marginal new high late on Friday, so the uptrend is intact.

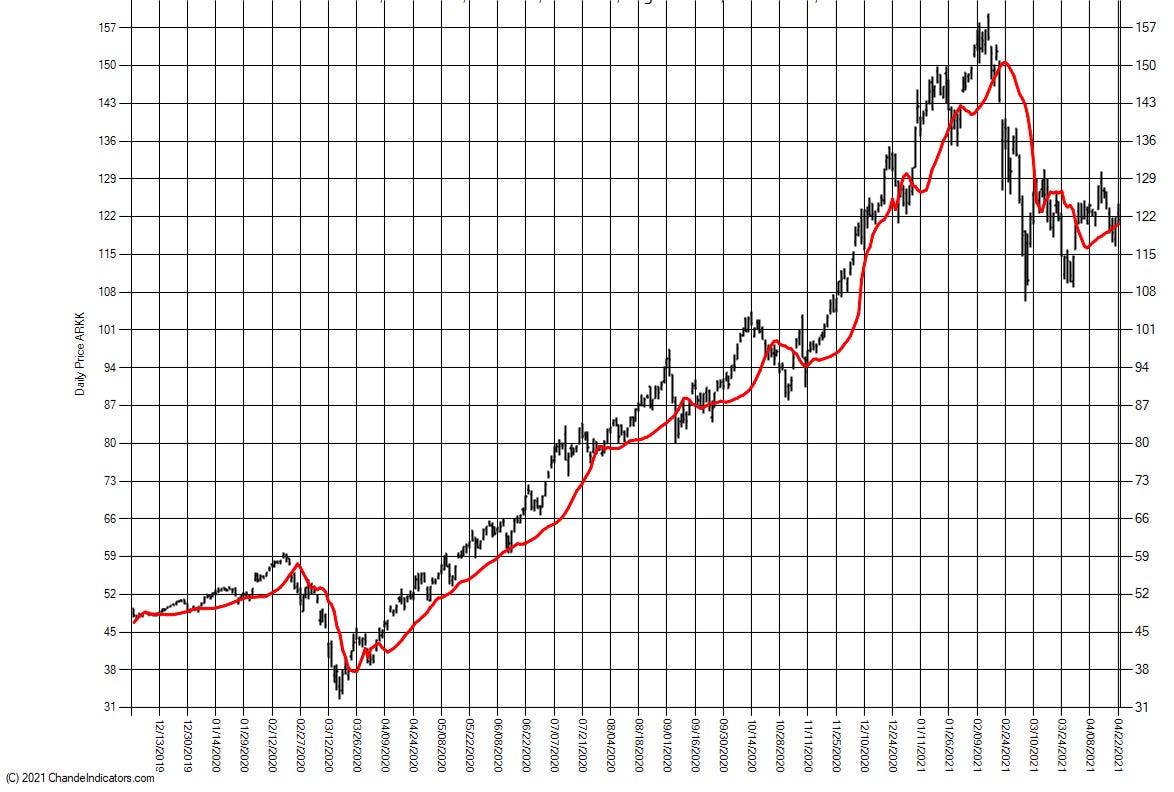

Whatever Happened to the ARK Funds?

The ARK ETFs, particularly the ARKK (Ark Innovation ETF) had a spectacular run from the March 2020 lows. Magically, around the start of the latest uptick in COVID-19 cases, this fund topped and has retraced some 32.8% of its move off the bottom. The chart for the other ARK funds are quite similar. The chart suggests that more consolidation is needed before another big run. The stars of the rebound are waning (see Zoom - ZM), and new leadership will emerge for the next leg of the bull market.

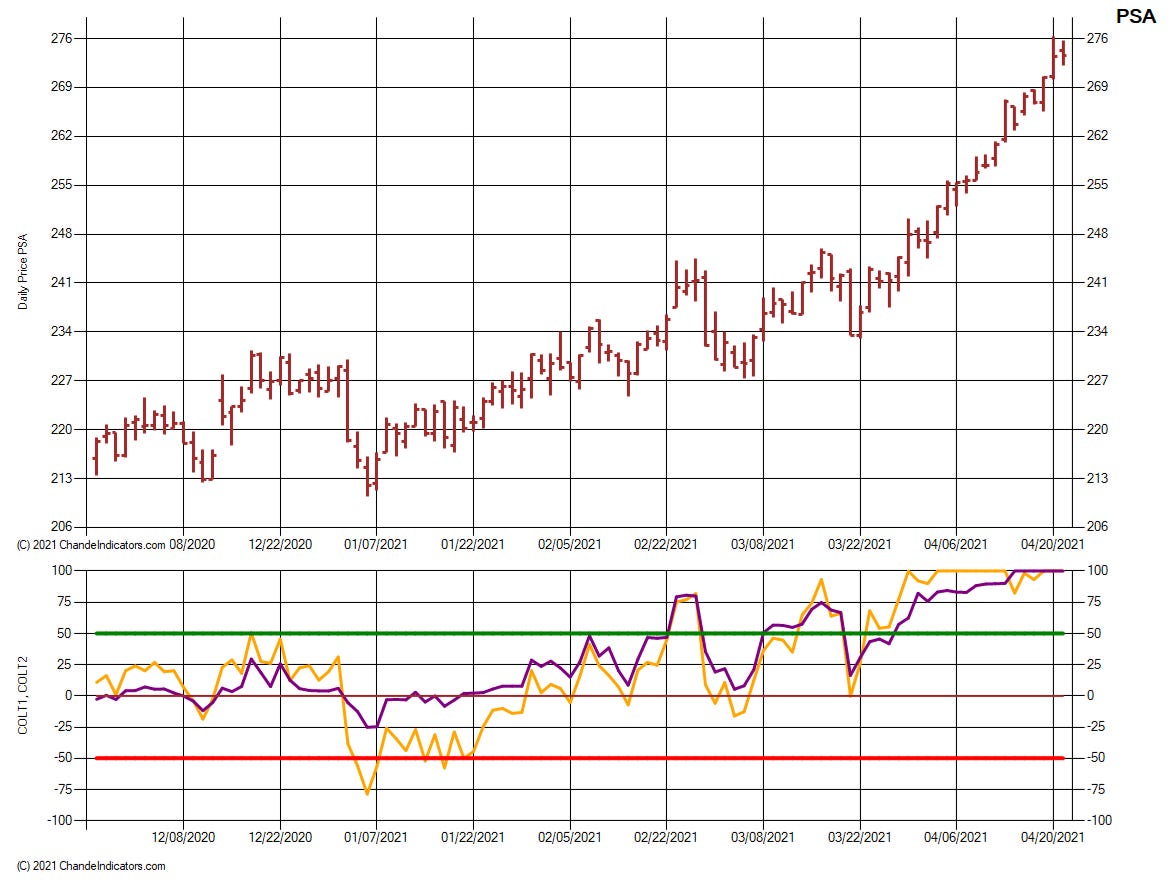

Chart of the Week

The $REIT index has trended nicely since mid-March, and the Public Storage (PSA) REIT has moved strongly, and broken out of a multi-year consolidation. Both of our long-term oscillators are confirming the move.

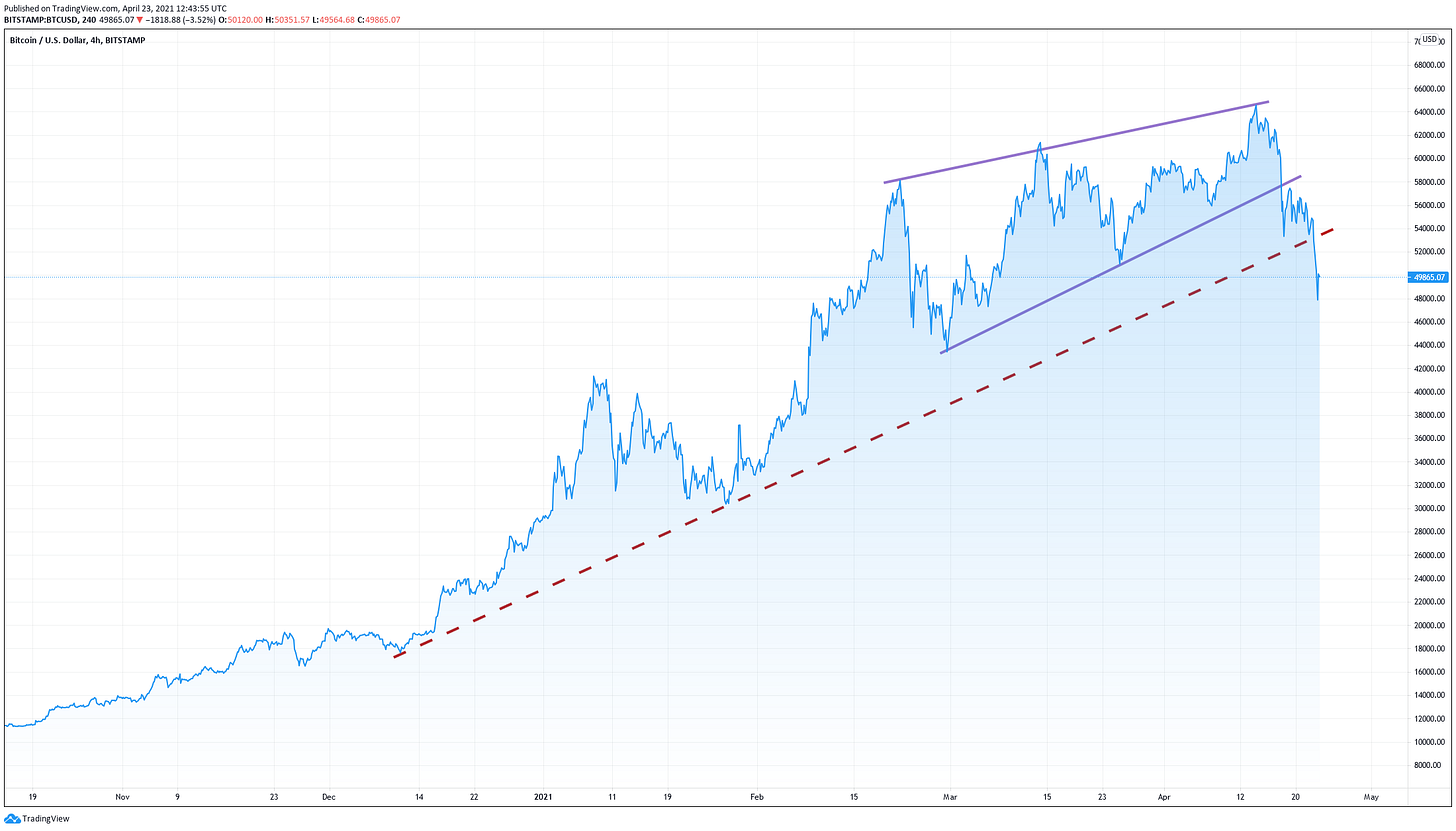

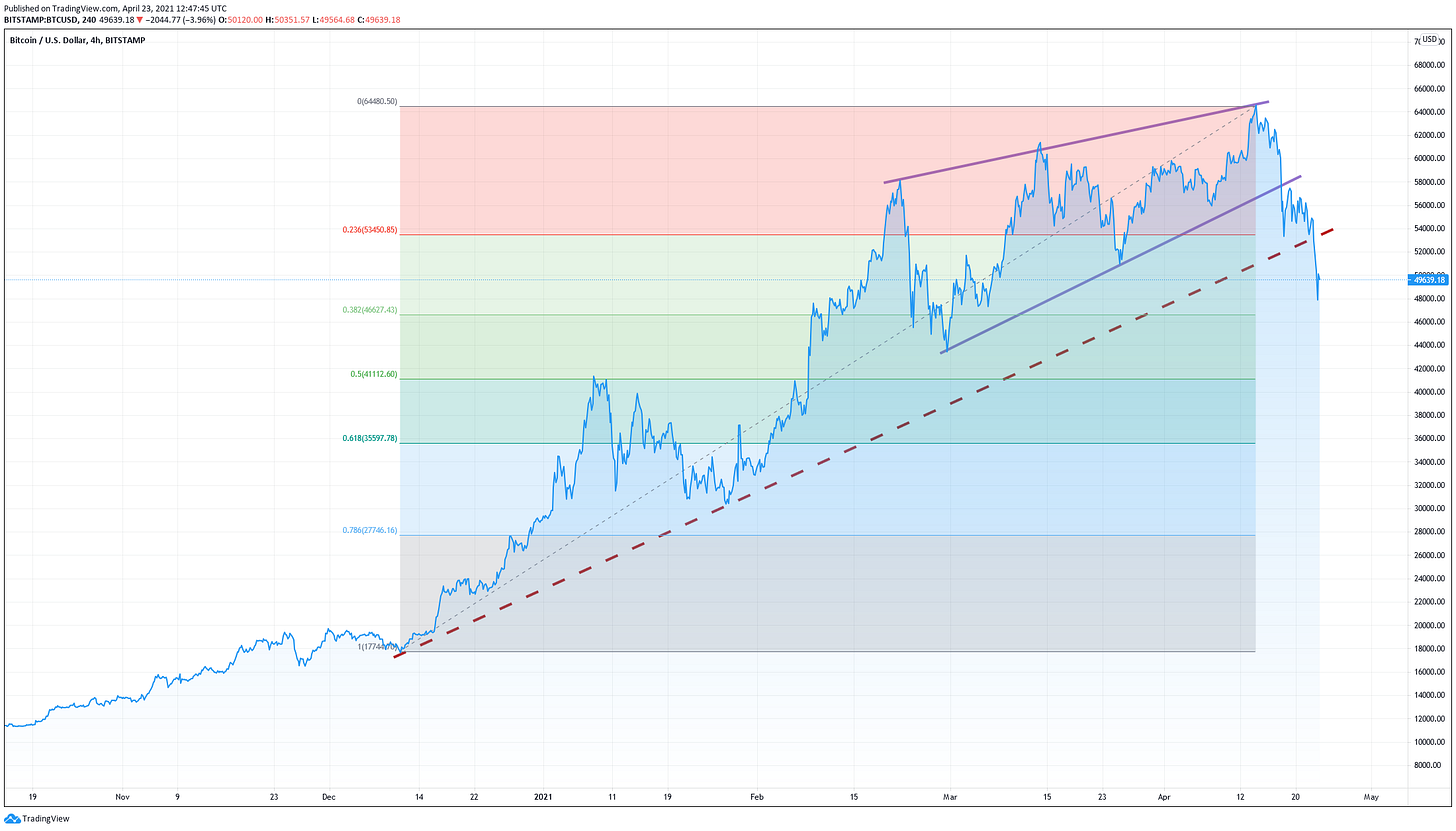

Cryptocurrency Stumble

The Coinbase listing could well mark a local top in the cryptocurrency markets. Bitcoin topped two weeks ago and is now down some -26.7% (peak to valley) at the time of writing. According to CoinMarketCap.com, the market cap loss exceeds some $218 billion. Some have speculated that the selling is tied to potential tax law changes which may be proposed by the president.

The Bitcoin chart looks weak. First, the parabolic rise since December has been broken decisively. Second, the market had formed a triangular upward sloping wedge, which can be a topping formation, and has now broken out of it to the downside. It has also broken below the long-term trend-line from December. If this rally is viewed as part of the broader rally in financial assets since the US election in November, then we can speculate that the Bitcoin selloff could spark a pause in that broader rally as well. Adding to the unregulated and “Wild West” nature of this market, the head of the Turkish Crypto Exchange aparently absconded with $2 billion in investor’s funds. Just this action could dampen the “animal spirits” of small speculators driving this move.

When contrasted with the stock markets, the Bitcoin market is largely an individual-driven market, with only a marginal institutional presence. Hence, even though the “animal spirits” may wane, the impact on stocks as a whole should be limited, as individuals and institutions continue their long-term commitment to the stock market. Stocks may bumble around a bit, but this could be just a proverbial pause that refreshes.

Mark Your Calendar: May 13, NinjaTrader Ecosystem Event

I will be doing a live event with the NinjaTrader Ecosystem Events covering my indicator package for the NinjaTrader 8 trading platform. Registration is required.

Wrap-up

If you like to do your own research, my posts should give you a good starting point, with context and suggestions. You can visit my website, chandeindicators.com, for more information and ideas. I hope you will stay tuned, and help, by subscribing, and recommending it to your friends and colleagues.

Thank you for spending some time with me.

Disclaimer

And now for some housekeeping. This publication is for “edutainment”, education, information, and entertainment purposes only. It is not to be construed as investment advice. Past performance is not necessarily indicative of future results. Our disclaimer at chandeindicators.com is included herein by reference.