70% Chance of Gains Through Year-End

A strong jobs report and strong tech stocks push market to new highs

Overview

Technology mega-caps lead the market higher.

The S&P-500 sustains its breakout.

Dow 30 plays catchup.

Small-cap stocks continue to lag their larger cousins.

Key Question:

Now that we have closed out an extraordinary eighteen-month stretch in the market, what can we expect for the rest of the year? We examine historical data for clues.

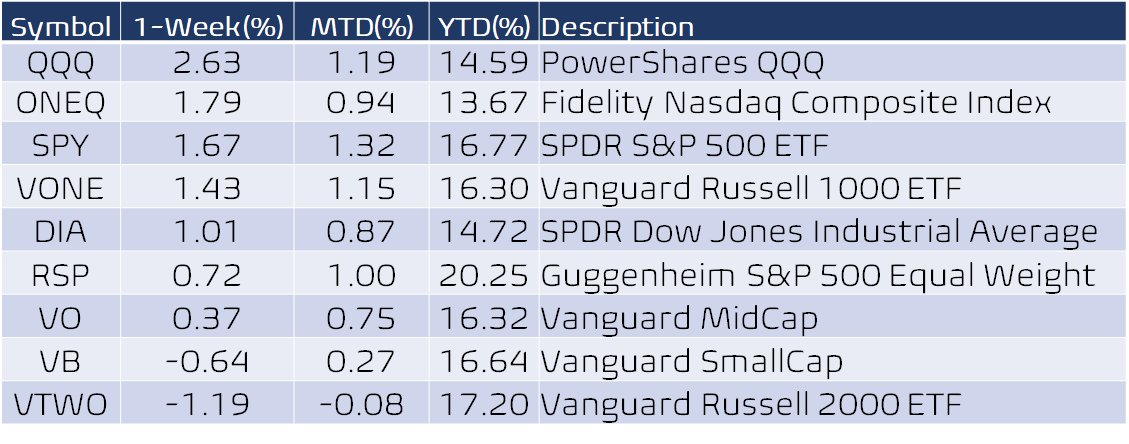

Performance Snapshot

A strong employment report (+850,00 jobs) and strong Technology sector mega-cap stocks pushed the market higher. The QQQ again flipped positions at the top of the performance table with the small-cap stocks (VTWO). The Dow 30 has played catch up after the FOMC meeting. But looking at the YTD performance, the equal weight S&P-500 ETF (RSP) leads the pack, which means the rally has been broad and relentless. However, small-cap stocks have been trading sideways since March, and the rally will lack real sustainability until they breakout as well.

Our bull-bear balance using leveraged and inverse ETFs ended the weak at about 60, which shows good strength. It weakened ever so slightly, but I expect the strength to continue.

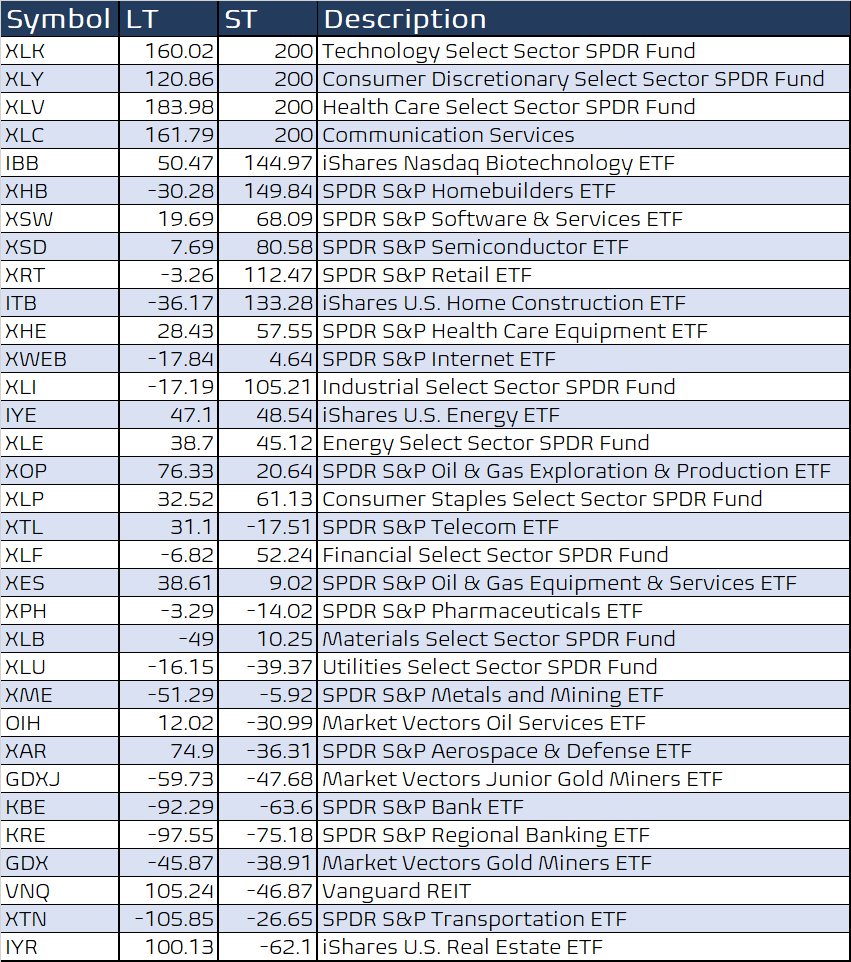

A look at the sectors shows that the four strongest sectors are technology, healthcare, consumer discretionary, and health care. The figure shows that most sectors are bunched up near the middle when comparing their short-term trend strength to their long-term trend strength. The four weakest sectors are gold miners, transportation, REITs, and real estate.

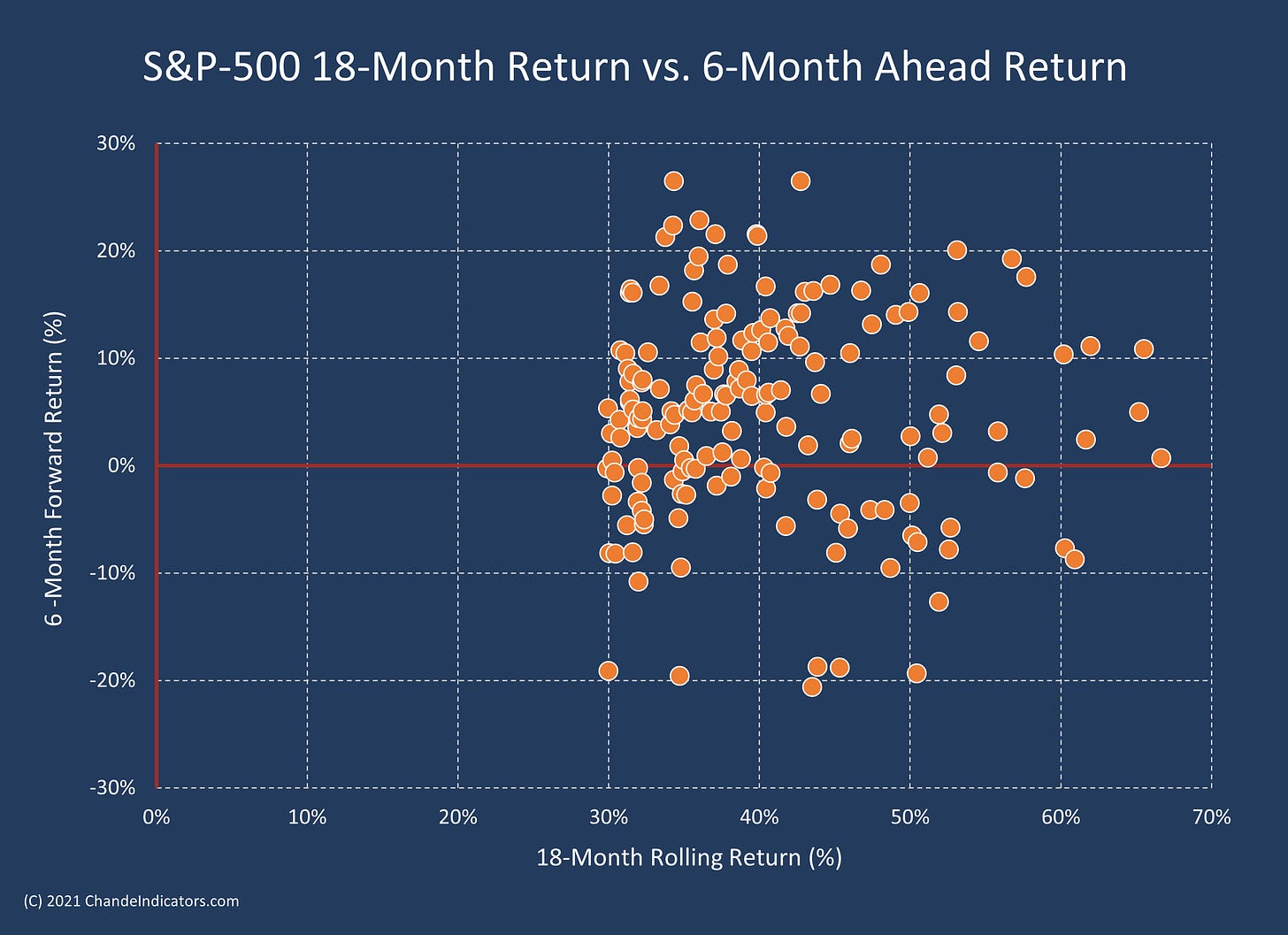

Analysis of S&P-500 data Since 1950

We examined the 18-month rolling returns of the S&P-500 and tried to relate them to 6-month ahead returns. Since the price change over the past 18-months was 33%, I asked what happened in the next six months after the market was up more than 30% over the past year and a half. I found 167 such occurrences going back to 1950 (see Figure below). In this data set, returns were positive over the next six months in 116 / 167 intervals (~69.5%) with an expected return of about +5%. Since there is plenty of scattering in the data (the standard deviation is about twice the average return), I would focus more on the 70% chance of the returns being positive over the next six months and worry less about projecting the actual return. The economic background is positive, and the Federal Reserve is in no rush to raise rates, so the macro picture is supportive of more new highs in the balance of the year. Naturally, the market will not go up in a straight line, but any pullbacks should be seen as temporary.

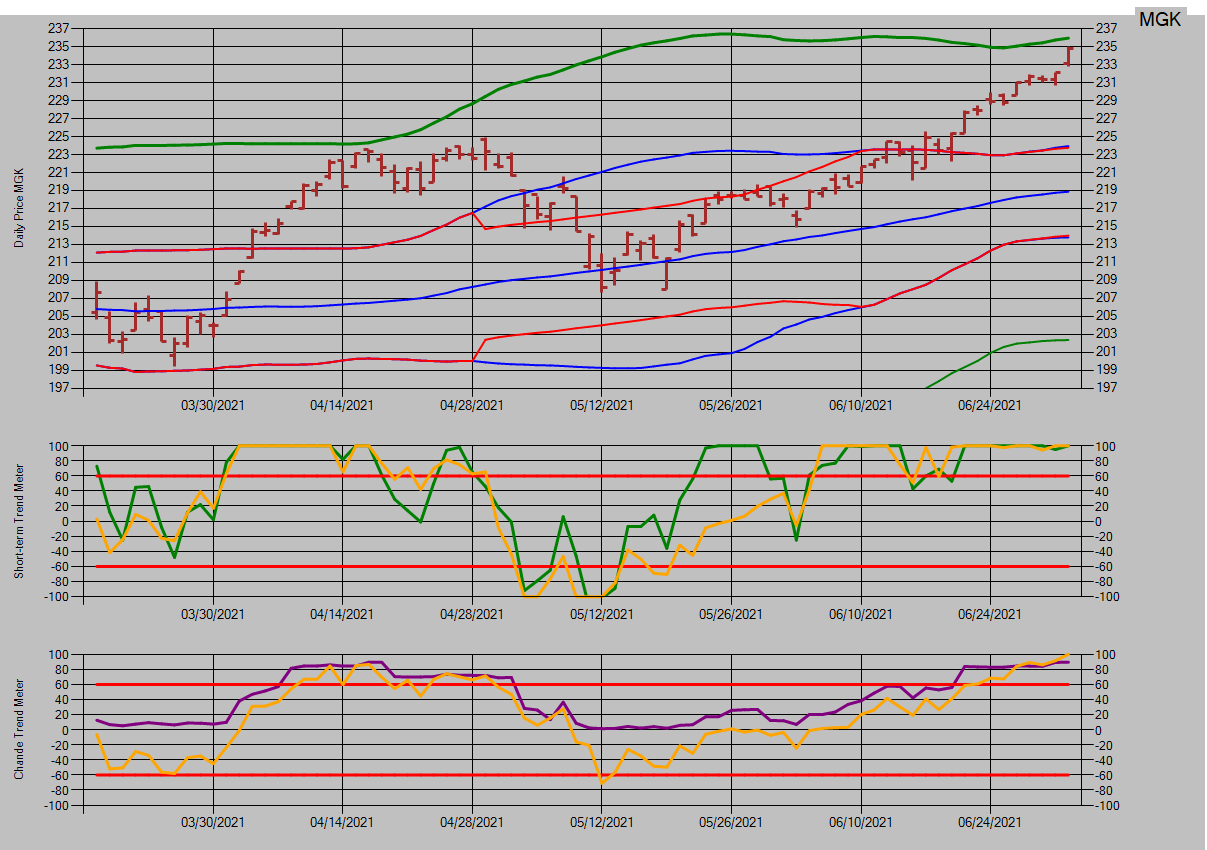

Vanguard MGK: An ETF to Remember

One of my favorite ETFs is the Vanguard MGK Mega Cap Growth ETF, which has a large exposure to Apple, Microsoft, Amazon, and Facebook, i.e., the mega-cap stocks pushing the market higher. Technically, it looks solid, and you should certainly take a good look at it when you can.

Wrap-up

If you like to do your own research, my posts should give you a good starting point, with context and suggestions. You can visit my website, chandeindicators.com, for more information and ideas. I hope you will stay tuned and help by subscribing and recommending it to your friends and colleagues.

Thank you for spending some time with me.

Disclaimer

And now for some housekeeping. This publication is for “edutainment,” education, information, and entertainment purposes only. It is not to be construed as investment advice. Past performance is not necessarily indicative of future results. Our disclaimer at chandeindicators.com is included herein by reference.